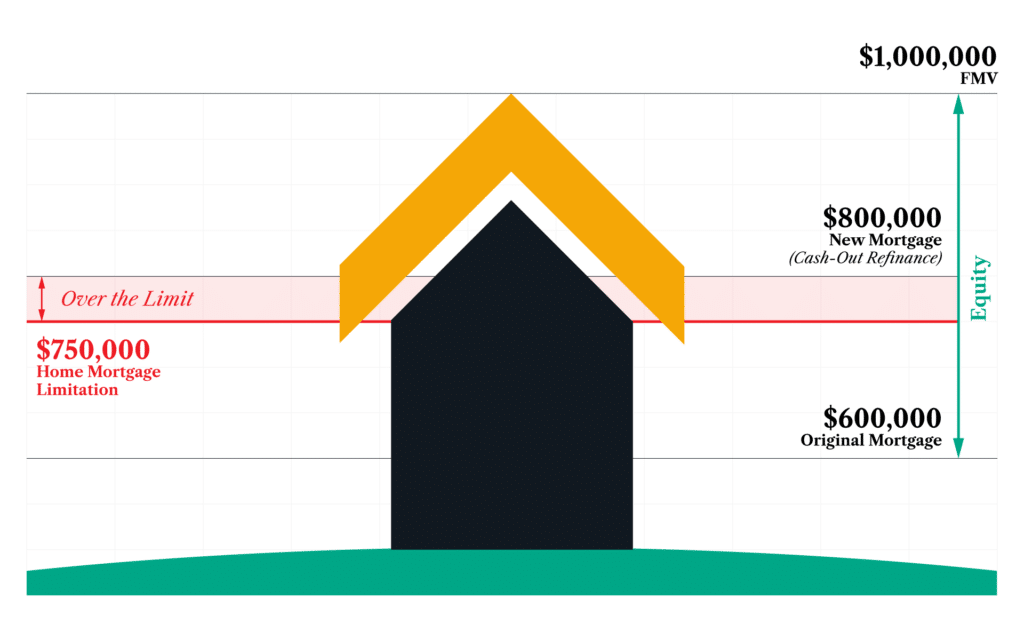

Mortgage Interest Limitation 2025. The tax cuts and jobs act (tcja), which is in effect from 2018 to 2025, allows homeowners to deduct interest on home loans up to $750,000. Mortgage interest deduction limit 2025.

What does the 2025 conforming loan limit increase mean for homebuyers? The mortgage interest deduction allows you to reduce your taxable income by the amount of money you’ve paid in mortgage interest during the year.

The home mortgage interest deduction (hmid) allows itemizing homeowners to deduct mortgage interest paid on up to $750,000 of their loan principal.

Canadian Mortgage Interest Rate Forecast to 2025 — Mortgage Sandbox, 2025 has marked a slowdown in the pace of growth for ev. Yes, your deduction is generally limited if all mortgages used to buy, construct, or improve your first home (and second home if applicable) total more than $1.

:max_bytes(150000):strip_icc()/CreatingaTax-DeductibleCanadianMortgage2_3-32287bf83e94406aba3b1d625e6c295f.png)

How To Calculate Mortgage Interest Limitation, For 2025, the maximum limit is $750,000 for. By rob wile and brian cheung.

The 750K Mortgage Interest Limitation Eric Sheldon, CPA PC, You can deduct home mortgage interest on the first $750,000 ($375,000 if married filing separately) of indebtedness. Before the tcja, the mortgage interest deduction limit was on loans up to $1 million.

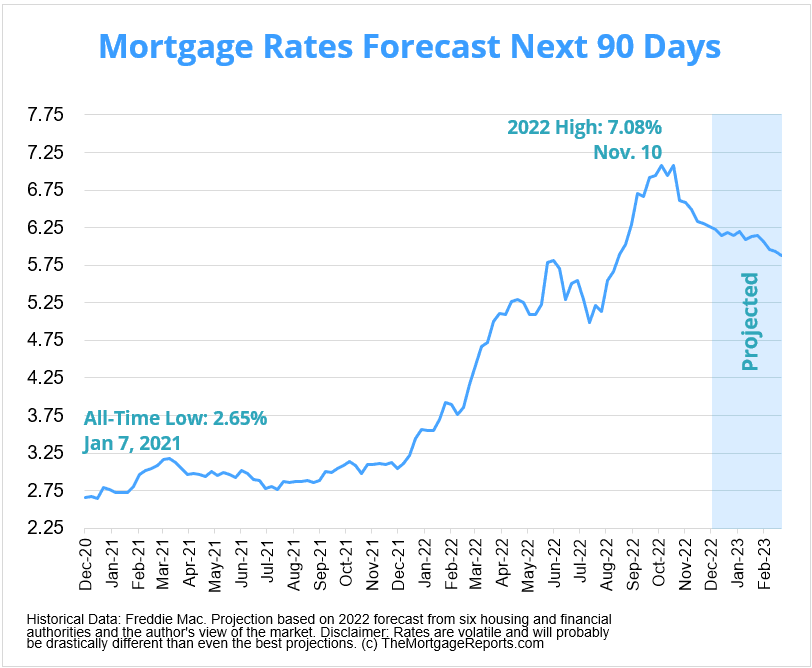

Mortgage Rates Forecast Will Rates Go Down In January 2025?, For the 2025 tax year, the standard deduction is $24,800 for married couples filing jointly and $12,400 for single people or married people filing separately. Yes, your deduction is generally limited if all mortgages used to buy, construct, or improve your first home (and second home if applicable) total more than $1.

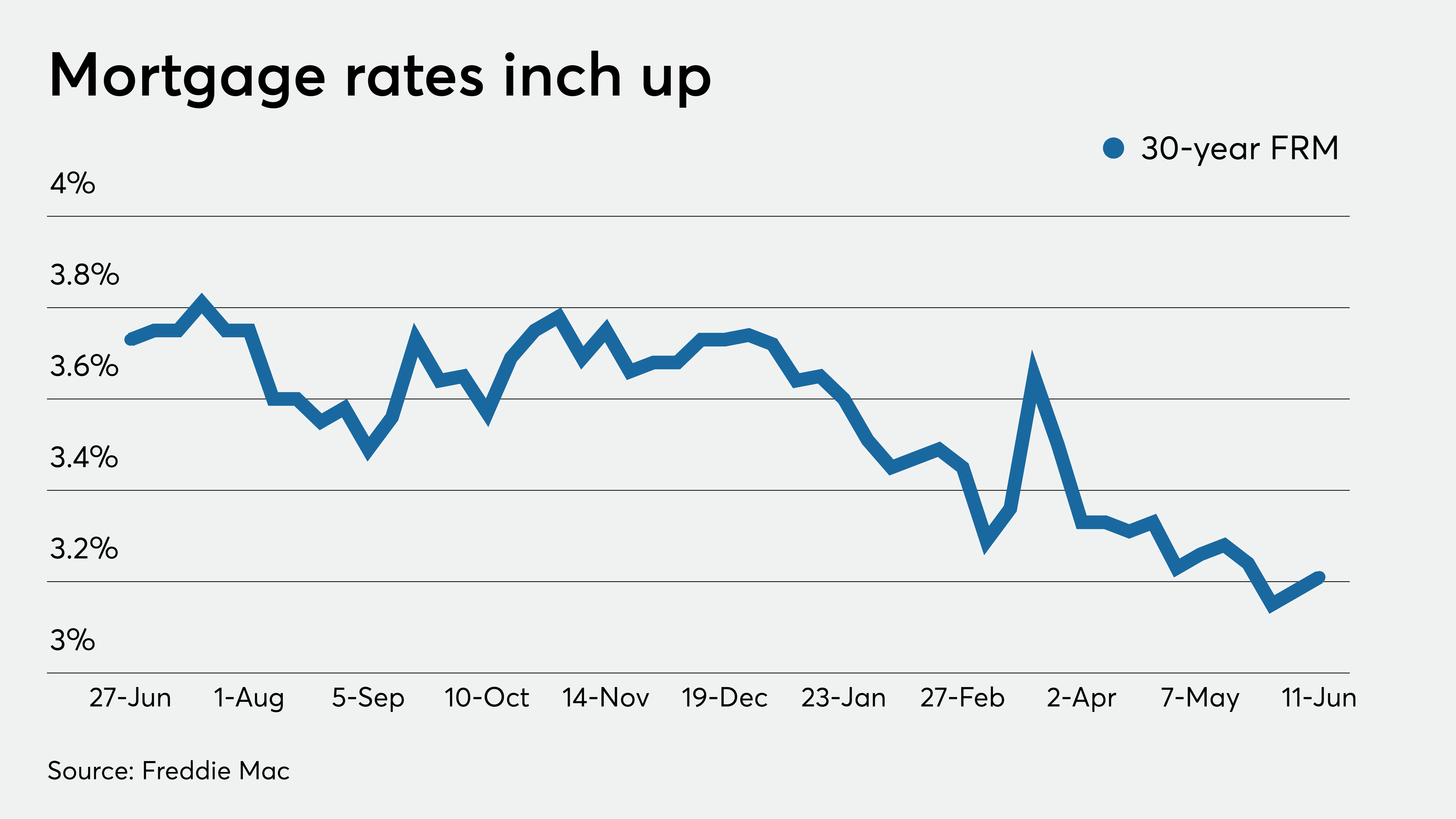

Planning to Move? You Can Still Secure a Low Mortgage Rate on Your Next, As stated earlier, your mortgage interest deduction limit depends on when you purchased your home and your filing. Updated on january 4, 2025.

Current Mortgage Interest Rates October 2025 (2025), Mortgage interest deduction limit 2025. Published 10:16 am edt, thu march 21, 2025.

Interest Rates Remain at Historic Lows… But for How Long? Real Estate, The home mortgage interest deduction (hmid) allows itemizing homeowners to deduct mortgage interest paid on up to $750,000 of their loan principal. Tax expenditure estimates from the joint committee on taxation (jct) indeed show that:

Canadian Interest Rate Forecast to 2025 — Mortgage Sandbox, The 2025 mortgage interest deduction: Don’t go over the loan limit.

Limitation On Home Mortgage Interest Deduction Tax Law Changes 2018, However, higher limitations ($1 million ($500,000 if married filing. The mortgage interest deduction is a tax benefit specifically for homeowners.

What the Fed’s 0 Interest Rate Plan Means for Mortgage Rates Muevo, This article examines how and to what extent the mortgage interest deduction incentivizes homeownership. By rob wile and brian cheung.